An employer can make the online PF payment either himself or through authorised banks. The employee becomes liable for paying TDS Tax deducted at source if the amount of EPF account exceeds the number of Rs.

Pf Relief May Be Taxing In The Long Term Mint

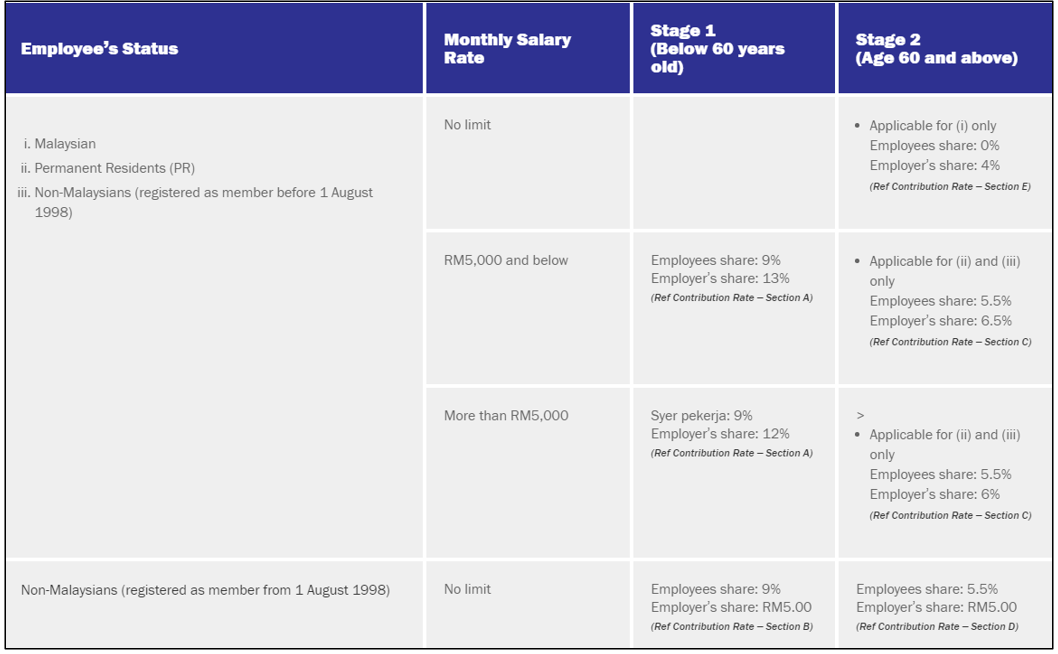

EPF Contributions at Malaysiapdf.

. EPF counters nationwide. EPF Late Payment Penalties. Upon late payment of EPF challan two arrears ensue on the employer as follows.

Similar to EPF SOCSO contribution will be deducted from both employees and employers funds and will be paid every 15th of each month. Latest news related EPF withdrawal. A late payment interest rate of 6 per year is imposed for each day such contribution is not paid on time.

From FY 2020-21 onwards the employers contribution to the EPF account shall become taxable if the contribution to EPF NPS andor superannuation fund exceeds Rs 75 lakh. EPF contributions at PDF copy. Every month 12 of the employees dearness allowance and basic salary is contributed to the EPF.

In case of non-restricted contribution PF will be on actual contribution ie 12 of 15500 1860 which is the Employee contribution. The Union Budget 2022 has amended the existing laws after which missing ITR for even one year can lead to higher TDSTCS in future financial years. Under E-E-E model investments interests withdrawals after 5 years are.

EPS contribution will be a maximum of 1250. The CBDT issued a circular on May 17 2022 clarifying on whom higher TDSTCS will be applicable in the current financial year FY 2022-23 and how tax deductors. The contribution split equally at the rate of 10 between the employer and.

This scheme makes employees working in the organised sector to be eligible for a pension after their retirement at the age of 58 years. The Central Provident Fund Board CPFB commonly known as the CPF Board or simply the Central Provident Fund CPF is a compulsory comprehensive savings and pension plan for working Singaporeans and permanent residents primarily to fund their retirement healthcare and housing needs in Singapore. The contributions towards EPF are made equally by the employer and the employee.

Investments in EPF is a profitable venture for salaried employees because of its exempt-exempt-exempt model. In this guide we discuss how employers can make PF online payments. 12 Employers contribution includes 367 EPF and 833 EPS.

Access to internet banking makes EPF contribution payments much easier now. Payment for unutilised annual or medical leave. An employees contribution to the EPF account is allowed as a deduction up to Rs 15 lakh under Section 80C of the IT Act.

Bank agents of Bank Simpanan Nasional Maybank Public Bank and RHB Bank. For all your contributions the government guarantees a minimum paid dividend rate of. The EPF interest rate for FY2020-21 was 850 unchanged from FY2019-20.

This contribution is made in equal ratio 12 each by the employer and the employee both. When an employee listed below has opted to make a contribution both such employee and employer shall be liable to contribute and the option may not be revoked. The CPF is an employment-based savings scheme with the help.

The Employees Provident Fund EPF is a retirement benefits scheme under the Employees Provident Funds and Miscellaneous Act 1952. Where the amount of the monthly contributions or part of any monthly contributions which an employer is liable to pay under section 45 is not paid within such period as prescribed by the Minister the employer shall be liable in addition to the dividend to be paid under subsection 453 to pay. Monthly EPF contribution brought down to 20 for May June and July 2020 will now go back to its erstwhile figure of 24 starting August 1 2020.

Any other remuneration or payment as may be exempted by the Minister. Thus if wages pertaining to April 2012 is paid on say 7th May 2012 due date for payment of Provident Fund contribution is 20th June 2012 ie. Wages for half day leave.

Delayed remittance of PF deposit will incur penal damages. When an employer fails to deposit the EPF contribution before its deadline then he is liable to pay an EPF interest of 12 pa. EPF Interest for Late Payment under Section 7Q.

50000 and the term of his job or service is less than five years. For an employer to make the EPF online payment they must be registered under the PF Act. A late payment charge or a dividend will be imposed if the EPF contribution is not paid on time.

15th June 2012 as increased by grace period of 5 days. E-Caruman website or mobile application. The EPF aims to build a retirement corpus for all the employees as a reward for their hard work and dedication for their jobs.

Regulated by the Employees Provident Fund Organisation EPFO the scheme requires the employer and employee to contribute 12 of the latters basic salary and dearness allowance DA towards the fund. PF Delay Payment interest. Register of Firms contains up-to-date information on all firms and can be viewed by anybody upon payment of certain fees.

Check our guide to conduct PF balance check. The charges as specified by the EPFO are as. The government fees applicable for a partnership firm registration varies from state to.

The amended law is effective from April 1 2022. Employer contribution will be split as. The EPF interest rate is reviewed every year by the EPFO Central Board of Trustees after consultation with the Ministry of Finance.

An employer who does not pay the contribution within the time limit shall be liable to pay simple interest at the rate of 12 per annum for each day of the default or delay in payment of contribution. There are a few channels SOCSO have disclosed on where employers may auto deduct from. Due date for payment of Provident Fund contributions is 15 days from the end of month in which wages are paid plus grace period of 5 days.

Late payment charges on contribution in arrears. For every single day that there is a delay in EPF payment. Who are liable for EPF SOCSO and EISs Contribution.

Payment Liable for EPF Contribution. The EPF contribution can be paid through the following channels. Key Points about EPF Contribution.

Any extra contribution will go into EPF. The review of the EPF interest rate for a financial year is set at the end of that financial year most probably in February but may go up to April or May. When an employee listed below has opted to make a contribution both such employee and employer shall be liable to contribute and the option may not be revoked.

Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule. The employer must pay their employees contributions on or before the 15th of the following wage month. How to make EPF payment.

EPF Contributions To Be Deducted at 24 from August 1 2020. Full time Malaysian employees 48 hours per week part-time employees with working hours between 30 to 70 with the company directors for Sdn. 10 EPF share is valid for the organizations where there are 20 or less than 20 employees organizations with losses incurred more than or equal to the net worth at the end of financial year organizations declared sick by the Board for Industrial and Financial.

The Employee Provident Fund Organisation EPFO has provided a social security scheme called the Employee Pension Scheme EPS. Employer contribution will be split as. Tax deduction on contribution to EPF account.

Some portion of the employees salary goes towards the EPF fund every month. Payments Liable For EPF Contribution Such As. The employer must pay their employees contributions on or before the 15th of the following wage month.

Partnership Firm Registration Fees.

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

Trending News Epf Latest News Interest Earned On Your Epf Contribution Is Not Being Taxed Check This Way Hindustan News Hub

Is Your Employer Depositing Pf Money To Epfo Or Trust If Not Then What To Do

Epf A C Interest Calculation Components Example

Myfreelys Academy Kwsp Definition Of Wages For Epf Purpose All Remuneration In Money Due To An Employee Under His Contract Of Service Or Apprenticeship Whether It Was Agreed To Be Paid

Epf Contribution Reduced From 12 To 10 For Three Months

How Does A Company Deduct Epf 12 Twice From Total Target Cash In A Month By Just Saying Epf Included In Salary Please Someone Explain In Terms Of Cognizant Tech Solutions Ctc

What Are The Employer And Employee Contribution To Epf Quora

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Income Tax Benefits On Epf Contribution Existing V New Tax Regime

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint

No Penalty On Employers For Delay In Provident Fund Contributions Decides Epfo The Financial Express

Everything You Need To Know About Running Payroll In Malaysia

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate

How To Calculate Provident Fund Online Calculator Government Employment

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

How Epf Employees Provident Fund Interest Is Calculated